While the EV industry saw a downturn in 2023 and the top manufacturers engaged in a price war to attempt and offset the decreased demand, Elon Musk’s Tesla (NASDAQ: TSLA) has shown itself to be remarkably resilient.

Not only did the company manage to maintain its growth in the number of vehicles produced and delivered, but it also saw a 117.95% increase in its stock since January 1st. According to a Bloomberg article from Tuesday, November 21, the EV manufacturer is now set to find a new channel of expansion as it is near to coming to a deal with the Indian government.

Through the agreement, Tesla may gain entry into a new market with well over a billion potential clients. It would also require the construction and startup of new factories

inside the nation. As soon as they leave the production lines, which are supposedly located in Tamil Nadu, Gujarat, or Maharashtra, Tesla cars might retail for as little as $20,000.

According to sources close to Bloomberg, the arrangement may be formally revealed during the Vibrant Gujarat Global Summit in January, and the new plants may begin operations in less than two years.

It is crucial to remember that India currently has a relatively low market for electric vehicles; just 1.3% of all passenger cars sold there last year were EVs. This may alter, though, if an Indian-made Tesla were to cost as little as $20,000. Recent building advances by Elon Musk’s company are probably responsible for this price drop, as they are planned to enable the production of a €25,000 ($27,365) model in the Berlin facility by 2024.

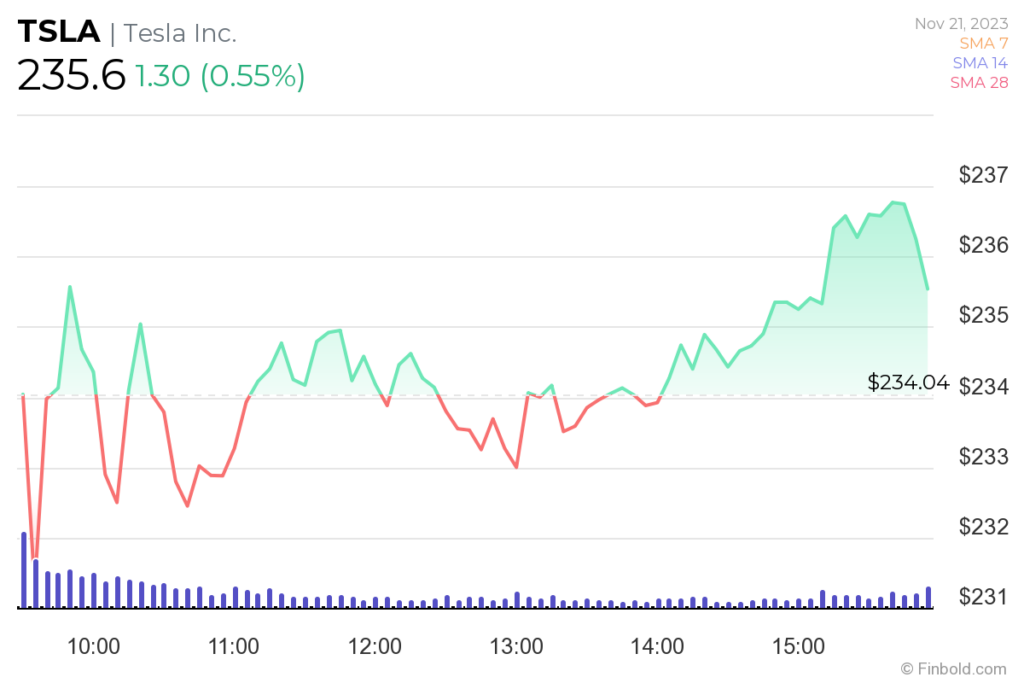

Tesla stock market price analysis

Tesla’s already outstanding stock market performance this year might be greatly enhanced by its entry into the Indian market. When this story was published, the company’s stock was trading at $235.60, up 0.55% over the previous day.

Additionally, Tesla’s performance throughout the year has been strong as it is not only up 117.95% year-to-date but is also 11.09% in the green in the 30 days and 24.74% up in the last 6 months.