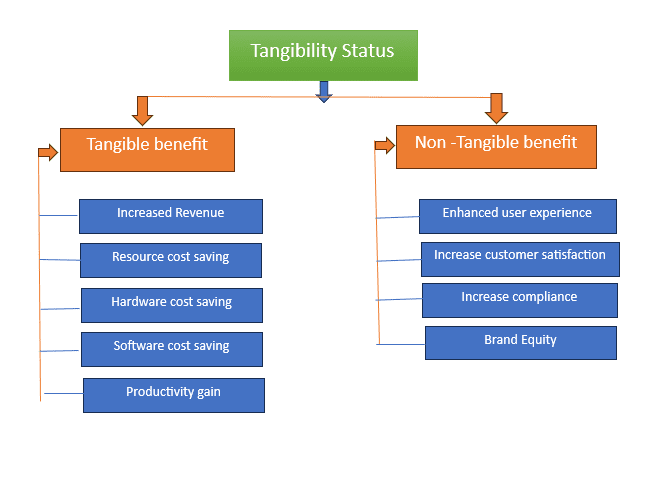

Rising intangible assets on corporate balance sheets all over the world could restrict acquiring limits and thus upset development if firms should protect cash and renounce investment opportunities. We show that financial development brings down the responsiveness of cash holding to tangible resources and advances firm development. We likewise find that areas with a more modest extent of tangible resources fill quicker in nations with additional created financial business sectors. Our investigation uncovers a significant resource tangible quality channel through which monetary improvement works with firm development.

A negative money tangibility quality responsiveness — the increase in real money savings related to declining resource tangibility — is possibly expensive. As the make-up of corporate resources shifts toward intangibles, development could be obliged on the off chance that organizations need to renounce venture to safeguard cash. This cost could be more hindering for firms working in nations with immature monetary business sectors where credit supply and elective financing sources are scant.

We utilize a few techniques to carefully look at the speed of our discoveries and to mitigate the worry that the effect of financial improvement on cash-substance responsiveness is puzzled by other financial powers. In the first place, we parcel the example in light of a few significant nation-level factors (e.g., Research and development venture and normal pay) to dig further into the impact of financial improvement on cash-tangibility responsiveness.

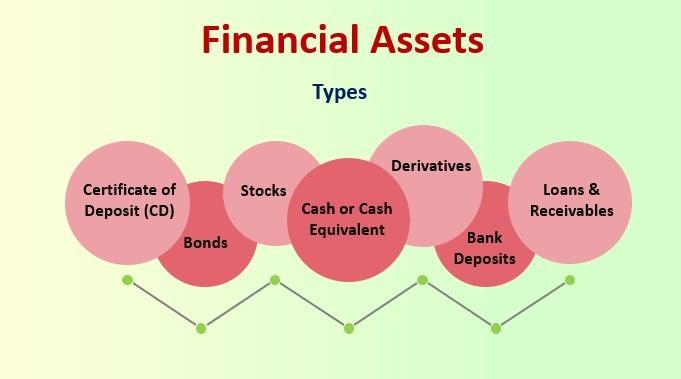

Financial assets highly impact on company development because our economy stability depend on financial assts. Financial assets decide the GDPR of the company if the company assets gain high profit it beneficial for any state

.

If your company assets has remarkable progress in market than you are become the hih ranked profitable organization of the state and your brand become popular..

First of all Finance is the piler of any organization. If your brand become popular among other than your GDPA is high your production will be increase its also increase your brand and product availability in the UAE market.

Second, trying to retain the effects of a few types of discarded factors, our standard relapse particular is increased to incorporate firm-level and different intuitive fixed impacts. Third, we direct an IV examination to address the expected endogeneity of asset tangibility in deciding cash holding. Last, we consider a few elective proportions of financial improvement to give a more extensive evaluation of its job on cash-substantial quality responsiveness. Our standard outcomes are powerful to a battery of heartiness checks.

Financial advancement could direct the reliance of money and speculation arrangements on resource tangible quality and encourage firm development by working with the utilization of intangible resources as guarantee and by advancing the adoption of elective instruments, for example, contracts to prevent borrowers’ risk shifting.

See the latest mortgage and auto loan rate by clicking this: click here or this click here

Follow us on our social media platform: