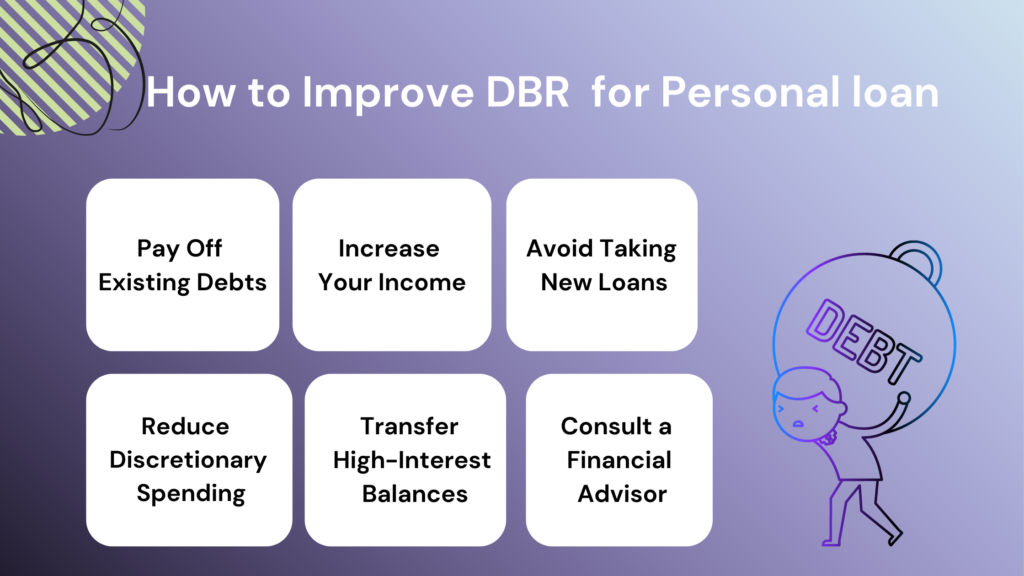

Improving the Debt Burden Ratio (DBR) in the UAE for personal loans requires a strategic approach to managing debt and income. Here are several ways to improve DBR:

1. Increase Income

- Explore Additional Income Streams: Consider secondary sources of income, such as freelancing, side businesses, or investments.

- Ask for a Salary Increase: If your current job allows it, negotiating a raise will directly improve your DBR.

2. Reduce Existing Debt

- Pay Off High-Interest Loans: Prioritize paying off high-interest loans and credit cards to reduce the overall debt burden.

- Consolidate Debt: Combining multiple loans into one with a lower interest rate can help manage monthly payments better.

3. Refinance Loans

- Negotiate Better Terms: Approach your lender to renegotiate the loan terms to reduce monthly payments or interest rates.

- Extend Loan Terms: Extending the repayment period can lower your monthly payments, improving your DBR.

4. Avoid New Debt

- Delay Large Purchases: Hold off on taking out any new loans or financing large purchases until your DBR is at an acceptable level.

- Manage Credit Usage: Avoid overextending your credit cards, as high utilization rates can negatively affect your DBR.

5. Budget and Financial Planning

- Create a Realistic Budget: Track income and expenses to avoid unnecessary spending and manage finances effectively.

- Cut Non-Essential Expenses: Reducing discretionary spending can free up more income for loan payments, improving your DBR.

6. Improve Credit Score

- Timely Payments: Ensure all loan and credit card payments are made on time to build a strong credit history.

- Maintain Low Credit Utilization: Keeping credit card balances low relative to their limits can improve both your DBR and credit score.

By implementing these measures, individuals can significantly improve their DBR, which increases their eligibility for personal loans at favorable terms in the UAE.

Apply Now Here.