Improving your credit score in the UAE is essential for obtaining better terms on credit cards and other financial products. Here are some steps you can take to improve your credit score:

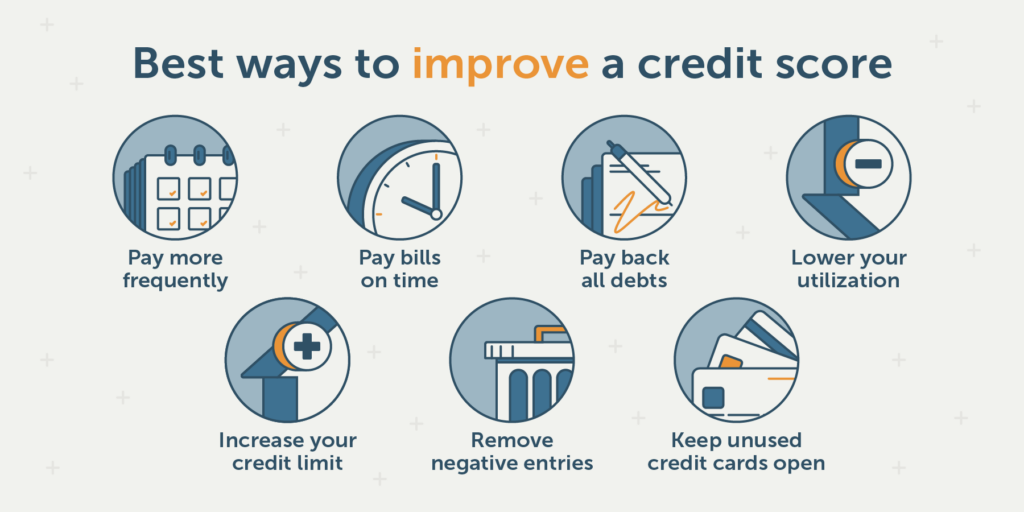

- Pay Your Bills on Time: Consistently paying your credit card bills, loans, and other debts on or before the due date is crucial. Late payments negatively impact your credit score.

- Reduce Credit Card Balances: Keep your credit card balances low relative to your credit limit. Aim to use no more than 30% of your available credit.

- Limit New Credit Applications: Each time you apply for new credit, it triggers a hard inquiry on your credit report, which can slightly lower your score. Only apply for new credit when necessary.

- Clear Outstanding Debts: Pay off any outstanding loans or credit card debts. This will not only improve your credit score but also reduce your financial burden.

- Review Your Credit Report: Regularly check your credit report for any errors or discrepancies. You can get a free credit report annually from Al Etihad Credit Bureau (AECB). Dispute any inaccuracies that you find.

- Maintain a Healthy Credit Mix: Having a mix of credit types, such as credit cards, loans, and mortgages, can positively influence your credit score, provided you manage them responsibly.

By following these steps, you can gradually improve your credit score and increase your chances of getting approved for a credit card with favorable terms in the UAE.