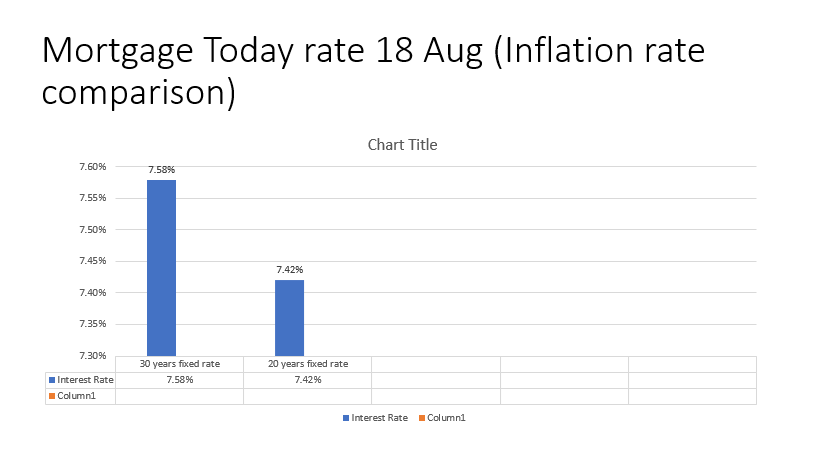

The present national mortgage financing rate trend in market.

On Wednesday, August 23, 2023, the ongoing average interest rate for a 30-year fixed contract is 7.58%, rising 18 basis points since a similar time the week before. For homeowners looking to refinance, the present public 30-year fixed refinance interest rate is 7.74%, rising 28 basis points contrasted with this time a week ago. Furthermore, the present average 15-year refinance interest rate is 6.90%, rising 15 basis points contrasted with this time the week before. Whether you’re purchasing or refinancing, now frequently has offers well show the average rate, showing the loan fee, APR (rate in addition to costs), and assessed monthly installments to assist you with contrasting arrangements and money your home for less. With interest rates expanding, it means quite a bit to search for contract offers prior to focusing on a loan.

How to get best mortgage in market

Getting the most ideal rate on your home loan can mean a distinction of many additional dollars in or out of your spending plan every month — also thousands saved in revenue over the existence of the Loan. You won’t understand what rates you fit the bill for, however, except if you correlation shop. This is the way to make it happen:

Figure out what kind of home loan is appropriate for you. Consider your credit score assessment and down payment, how long you intend to remain in the home, the amount you can manage monthly payments, and whether you have the risk capacity to bear a variable-rate loan and fixed-rate loan.

Look at mortgage rates. There’s just a single method for being certain you’re getting the most ideal that anyone could hope to find rate, and that is to shop something like three loan specialists, including enormous banks, credit associations, and online moneylenders, or by utilizing a home loan merchant. Nowiz offers a home loan rates examination instrument to assist you with tracking down the right rate from various moneylenders.

Remember: Home loan rates change day to day, even hourly, in light of economic situations, and shift by loan type and term.

Pick the best home loan offer for you.

Neowiz mortgage rates comparison can assist you approximately your monthly mortgage payments, which can be valuable as you think about your financial plan. Look at the APR, in addition to the interest rate. The APR is the total cost of the loan, including the interest rate and different fee. These fee are essential for your closing costs.

See our social media platform: