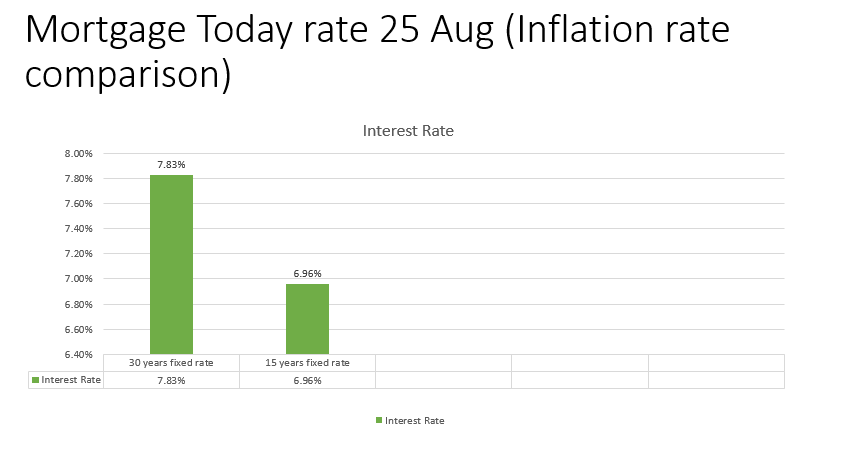

On Friday, September 22, 2023, the ongoing normal interest rate for the benchmark 30-year fixed mortgage is 7.62%, rising 10 basis points since a similar time a week ago. On the off chance that you’re hoping to refinance your ongoing credit, the present current average 30-year fixed refinancing cost is 7.78%, up 13 basis points from seven days prior.

In the meantime, the present current typical 15-year refinance loan interest cost is 6.89%, up 3 premise focuses over the course of the past week. Whether you’re hoping to purchase or refinance. Neowiz marketing frequently approaches offers underneath the public normal.

showing the loan fee, APR (rate in addition to costs), and estimated monthly payments to assist you with looking at arrangements and money for your home for less. With financing costs on the ascent, it means quite a bit to search for mortgage rate offers prior to focusing on a Loan.

The typical rate on a 30-year mortgage remained at 7.32 percent this week, down from 7.36 percent last week, as indicated by Neowiz’s weekly public study of enormous loan specialists. Last week’s level was the most noteworthy point since December 2000, as per Neowiz’s information.

The increment reflects various elements, including the Central Bank’s proceeding with the battle against inflation, a new minimization of U.S. government obligation, rising Depository yields, and the blurring possibilities of a downturn.

Previous weak mortgage rate

The national bank in July raised rates a quarter point, its eleventh increment beginning around 2022, and it will consider another rate climb at its Sept. 20 gathering. While the Fed doesn’t straightforwardly set fixed mortgage rates, it lays out the general tone. As the national bank has supported its approach rate from zero in mid-2022 to 5.25 percent presently, mortgage rates have increased forcefully.

https://www.linkedin.com/company/88388066/

https://www.instagram.com/neowizmarketingmangement/