Investigation of the tradeoff between competition and financial stability has been at the focal point of scholastic and strategy debate for north than twenty years, particularly since the 2007-2008 worldwide monetary emergencies.

Here we use data on 14 Asia Pacific economies from 2003 to 2010 to examine the impact of bank contest, fixation, guidelines, and public organizations on individual bank delicacy as estimated by the likelihood and the bank’s Z-score.

The outcomes recommend that more noteworthy focus encourages Financial delicacy and that lower valuing power likewise instigates bank risk openness in the wake of controlling for an assortment of macroeconomic, bank-explicit, administrative, and institutional elements. As far as guidelines and establishments, the outcomes show that harder section limitations might help bank strength, though more grounded store protection plans are related to more noteworthy bank fragility.

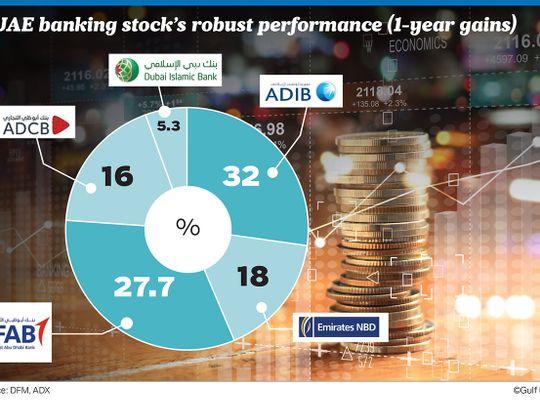

UAE Bank stock performance

To start with, past examinations have zeroed in on utilizing Z-scores or proof of a genuine bank emergency as proportions of banking area risk/steadiness. A genuine financial emergency can be a precise mark of banking area solidness, however its importance might be contorted for the accompanying reasons: banking emergencies are characterized and declared contrastingly across nation.

Controllers might be less disposed to report bank bankruptcies since they might suggest administrative disappointment.

Controllers are hesitant to declare the disappointments of banks that assume a key part inside the framework since they wish to stay away from disease impacts.

speculation play undermines the stability of banking in Asian markets

The processed utilizing the Dark and Scholes (1973) and Merton (1974) contingent cases approaches give a seriously engaging other option. Contrasted with the utilization of bookkeeping-based models, this market-based proportion of security enjoys the accompanying benefits: ineffective business sectors, stock costs mirror all suitable data; market factors are probably not going to be impacted by the association’s bookkeeping arrangements; and market costs reflect future expected incomes and consequently ought to be more proper for use for expectation purposes.

Best consultancy in UAE: Top DSA of UAE

Apply here for financial services: click here