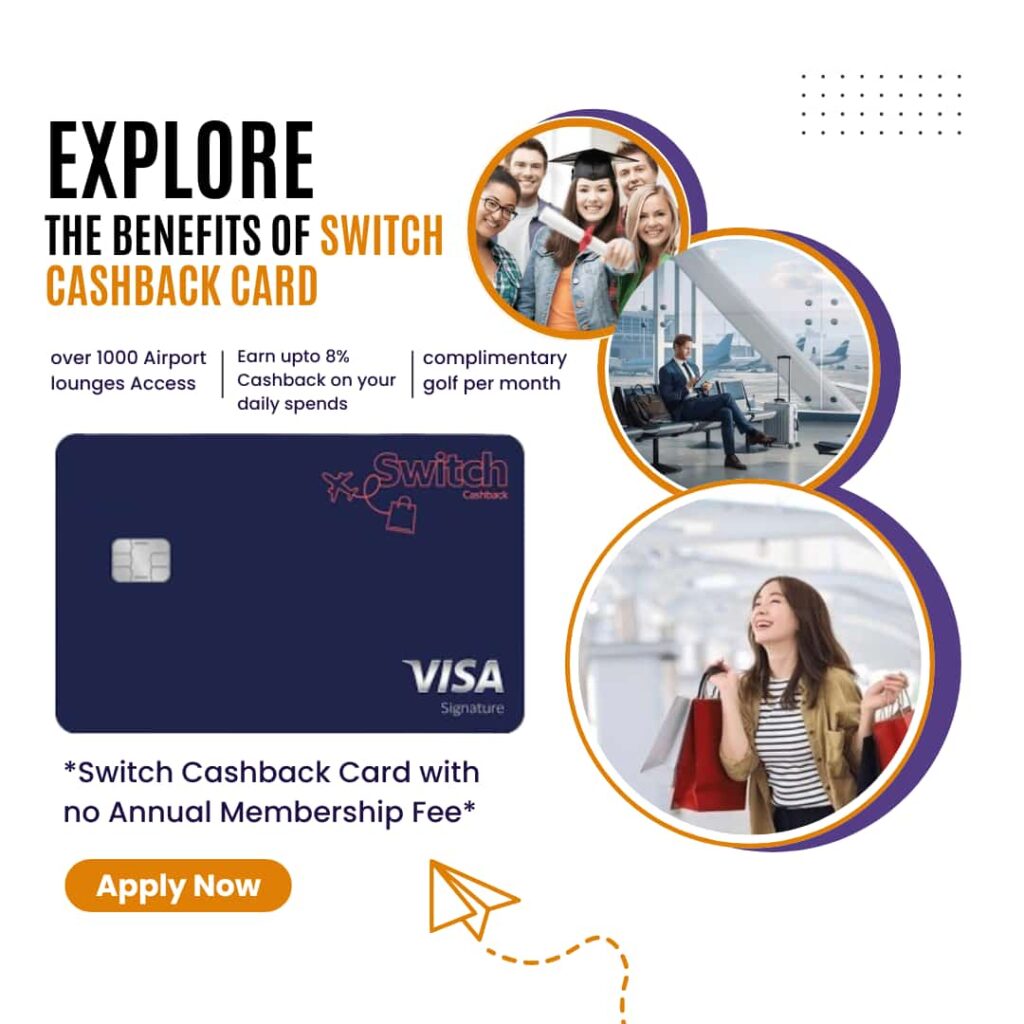

The Emirates Islamic Switch Cashback Card is a credit card offered by Emirates Islamic Bank, designed to provide cashback rewards on various types of spending. Here are some key features of the Emirates Islamic Switch Cashback Card:

- Cashback on Spending: Cardholders can earn cashback on different categories such as groceries, dining, fuel, and online shopping. The cashback percentage may vary based on the spending category.

- Shari’a-Compliant: As with all products offered by Emirates Islamic, the Switch Cashback Card is Shari’a-compliant, ensuring that all transactions adhere to Islamic banking principles.

- No Annual Fee: Some variants of the card might come with no annual fee, making it cost-effective for cardholders.

- Interest-Free Period: The card typically offers an interest-free period on purchases, which allows cardholders to avoid interest charges if the balance is paid in full each month.

- Global Acceptance: The card is widely accepted at millions of locations worldwide, making it convenient for both local and international use.

- Additional Benefits: Cardholders may enjoy other benefits such as complimentary airport lounge access, travel insurance, purchase protection, and exclusive offers on dining and entertainment.

- Easy Redemption: The cashback rewards can be easily redeemed, often as statement credits or other forms of redemption provided by the bank.

For the latest and most detailed information, it’s best to visit the Emirates Islamic Bank website or contact their customer service.