You gain good mortgage rate by by choosing the right financial advisor in UAE if you have good credit score and you are eligible for mortgage loan then you get loan from any reputed bank in UAE.

Every bank have different rate on mortgage on the basis of UAE national and expiate:

Today best DSA in UAE which have good customer services and fast application process to get loan from banks.

https://www.fintrekmarketing.com/

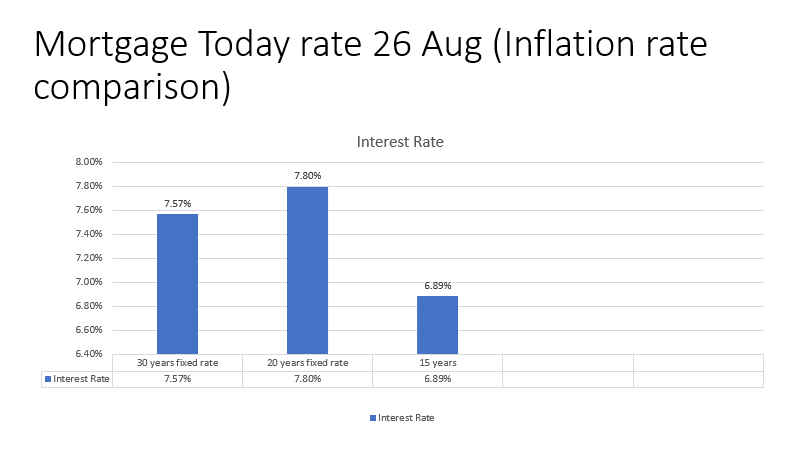

For now, Saturday, August 26, 2023, the current average financing cost for the benchmark 30-year fixed mortgage rate is 7.57%, Increasing 7 basis points as compared with this time a last week mortgage report. In the event that you’re on the lookout for mortgage loan, the national average 30-year fixed refinance rate is 7.80%, Increase 5 basis points focuses since a similar time the week before. meanwhile , the national 15-year refinancing interest rate is 6.89%, up 2 premise focuses throughout the past week.

Whether you’re hoping to buy or refinance, Neowiz frequently approaches offers well underneath the national average, showing the interest rate, APR (rate in addition to costs), and assessed monthly payment to assist you with contrasting arrangements and fund your home for less. With financing costs expanding, it’s a higher priority than ever to compare today’s mortgage interest rates before committing to a loan. Our best financial consultant guide you in taking the mortgage loan with minimal interest rate.

Mortgage inflation rate increase from previous years

Requirements for mortgage as nationals and expat is different: Non National have following requirement needs to be fulfil to get loan from bank. Valid UAE resident visa.

- Valid UAE resident visa

- Sources of income is eligible for mortgage loan.

- Expiate require larger down payment as compare to expiate.

- Down payment is typically the percentage value of the property around 20% to 25 %.

- Monthly salary requirements is based on bank policy.

- A good credit history is essential for approval of loan