A mortgage is a sort of loan explicitly used to purchase real estate, like a house or a property. A long-term loan is generally repaid over a time of 15 to 30 years, although different terms are likewise conceivable.

Types of mortgage loan

conventional mortgage: Best for borrowers with great financial scores.

Jumbo Loan: Best for borrowers with fantastic credit hoping to purchase a more costly home

Government-backed loan: Best for borrowers who have lower credit scores and insignificant money for a down payment.

Fixed-rate mortgage: Best for borrowers who’d incline toward an anticipated, set regularly scheduled installment for the duration of the loan

Adjustable rate mortgage: Best for borrowers who don’t want to remain in that frame of mind for a lengthy period, favor lower installments temporarily, and are right with perhaps paying more in the future

For now, Friday, August 25, 2023, the current average interest rate for the benchmark 30-year fixed mortgage is 7.61%, rising 6 basis points contrasted with this time a week ago.

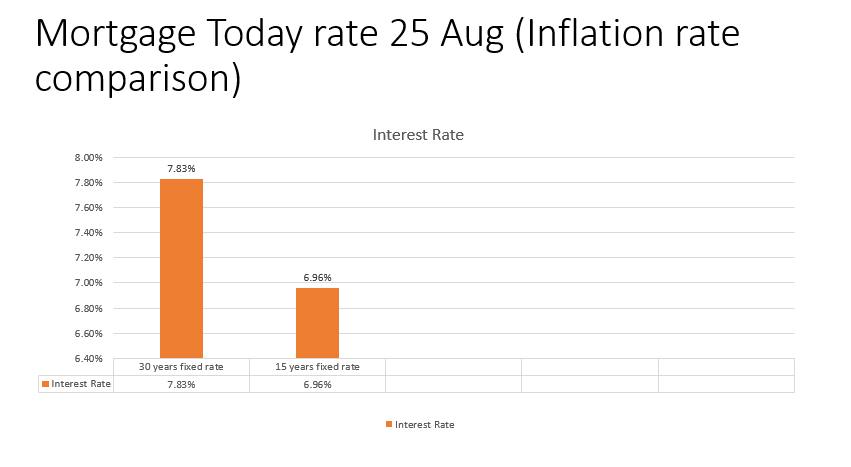

On the off chance that you’re hoping to refinance your current loan, the national 30-year refinance cost is 7.83%, rising 12 basis points contrasted with this time the week before.

In the interim, the national average 15-year refinance loan cost is 6.96%, rising 6 basis points throughout recent days. Whether you are buying or refinancing, Neowiz frequently has offers below the national average, showing the interest rate, APR (rate in addition to costs), and estimated monthly payment to assist you with contrasting arrangements and fund your home for less.

With interest rates on the rise, it means quite a bit to search for mortgage offers prior to focusing on a loan.

Our company provide mortgage rate with lowest rate as compared to other companies try to reduced your expense as well as possible.

Apply for mortgage loan in our company websites:

Follow us on our social media platform: